There are cycles in markets, societies and most things, actually…

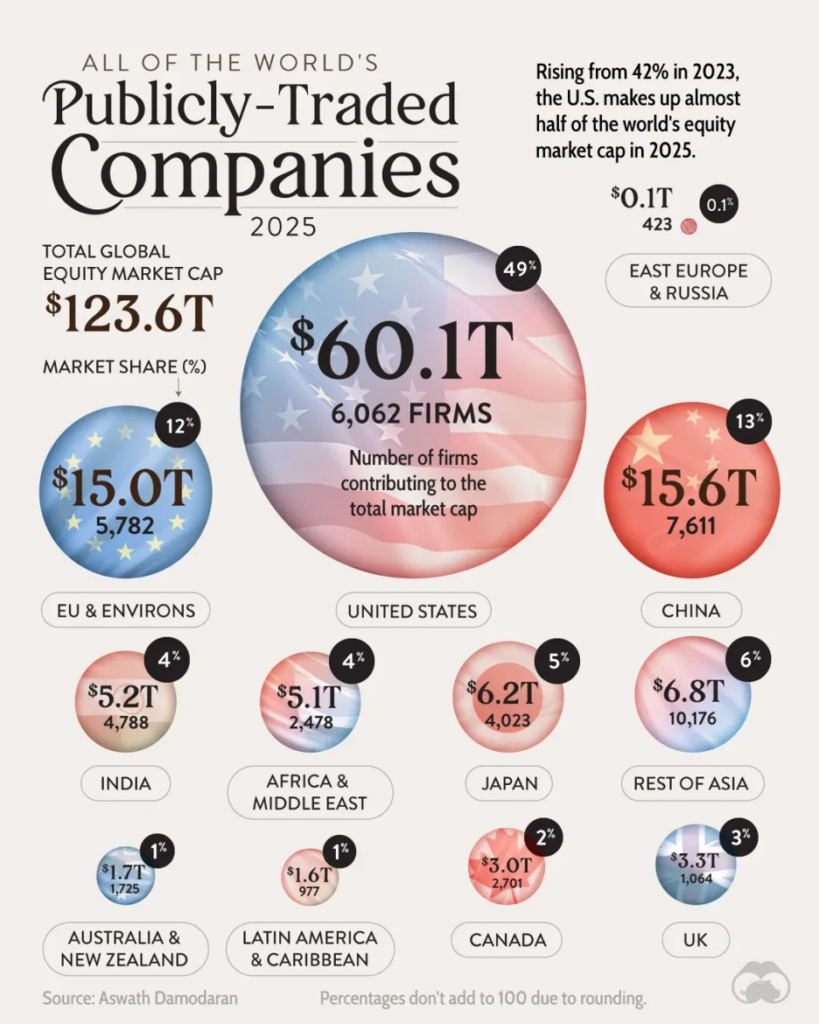

US Equity markets have had a good run, accounting for 49% of Global equity value at the end of 2024.

America’s dominance of the global stock market is unrivaled, and its share has only grown in the past two years.

The outperformance of the S&P 500 has played a role in America’s leading position, averaging 14.8% compound average returns over the past decade. (Since 2002 the CAGR is 8.5%) Global equities, represented by the MSCI ACWI (excluding the U.S.) Index, have returned 7% by comparison.

There are some very interesting opportunities in Emerging markets lately. Think Javier Milei in Argentina. India has a very pro capitalism Prime Minister. Will Canada move away from their socialist leaning Prime Minister and cabinet on the next election coming soon?

China is ranked #2… will demographics and their “one child” policy and selective abortion be their undoing? One thing in their favor is they have been building roads with their foreign aid dollars while the US has been promoting DEI and other woke agenda’s…

We are definitely living in interesting times.