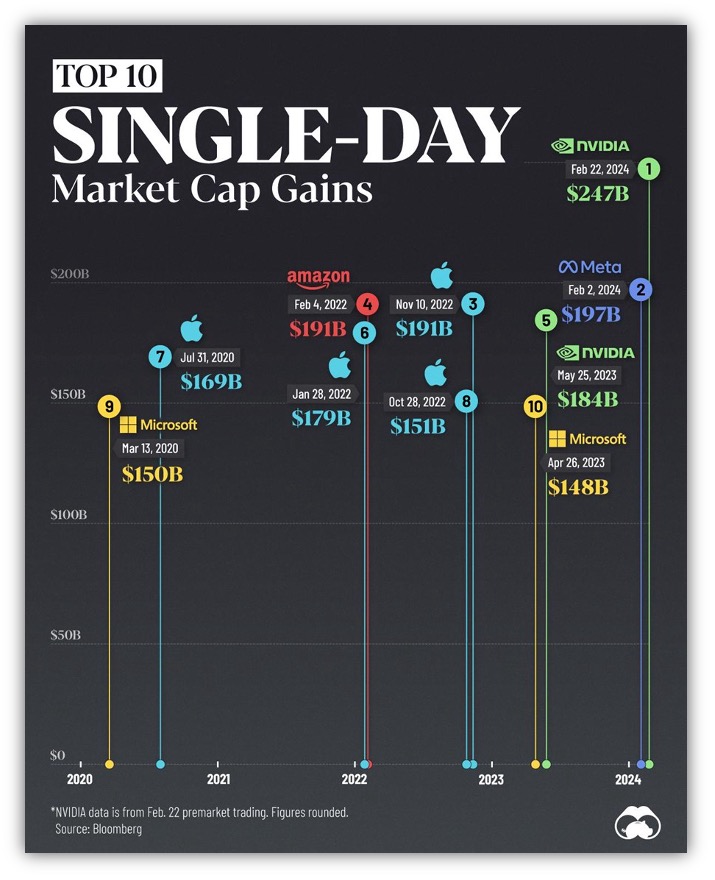

Last week, semiconductor Nvidia reported blowout earnings that beat even the most sky-high expectations. Nvidia climbed about 16% hitting a record high—and added $277 billion to its market cap—the largest single day increase ever.

When you look at the visual below, you’ll see that the top five large cap single-day gains have all been made in the last two years.

To put that massive gain in perspective, about this time last year the average market cap of an S&P 500 company was $30.4 billion.

Time for a CAPE review…

The CAPE is now at 34.25, up from the prior week’s 33.69.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”).

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first and ask questions later…… FOMO……………Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

Back to last week…

Sherman Analytics has input on this article.