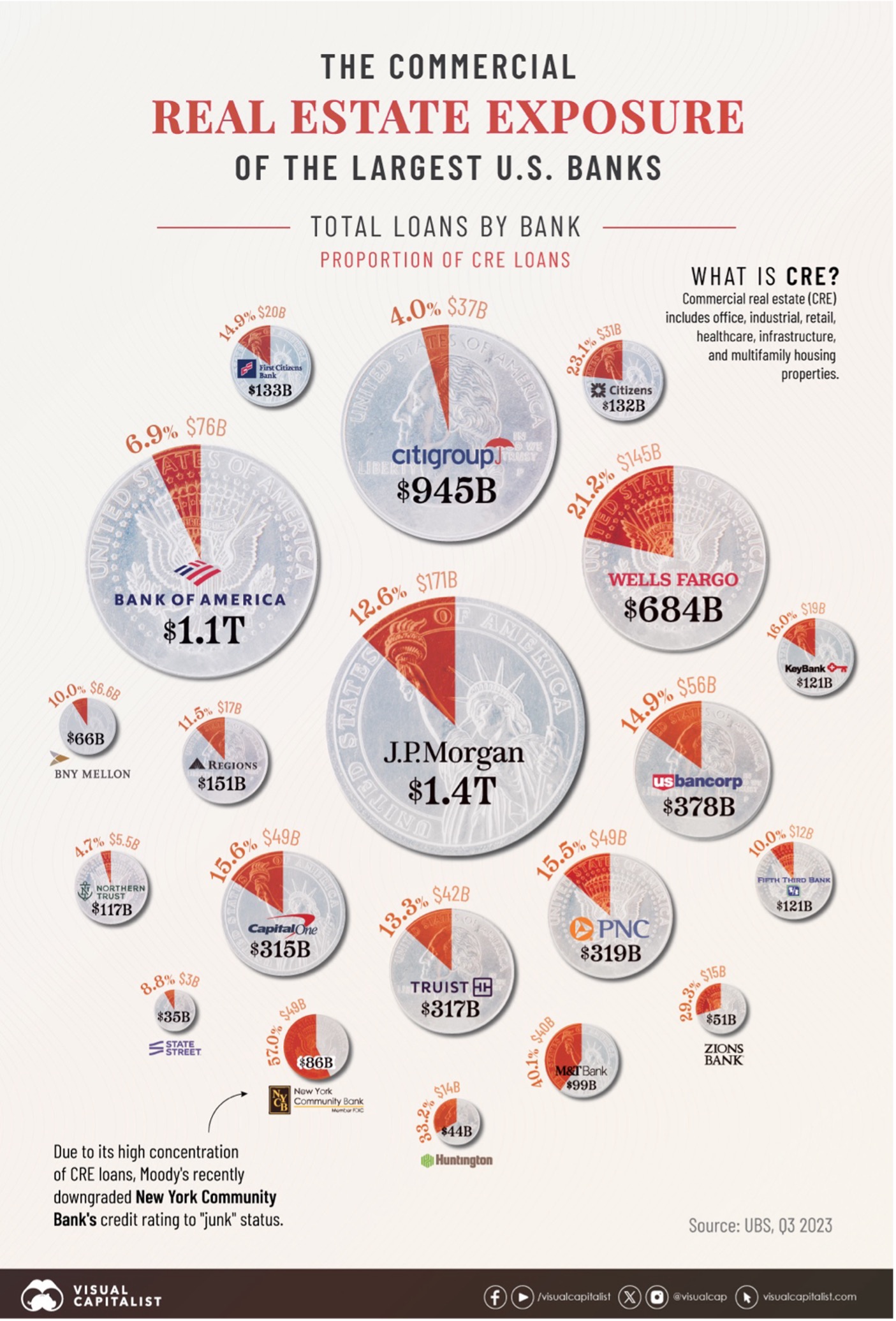

The six largest U.S. banks saw delinquent commercial property loans nearly triple to $9.3 billion in 2023 amid high vacancy rates and increasing borrowing costs.

For almost half of all U.S. banks, commercial real estate debt is the largest loan category overall. While commercial loans are more heavily concentrated in small U.S. banks, several major financial institutions have amassed significant commercial loan portfolios.

Several major banks, such as Wells Fargo, are building bigger cash reserves for commercial property credit losses as a buffer for potential defaults.

Overall, while pockets of trouble are surfacing, major banks are more insulated from commercial property shocks compared to other banks. On average, about 11% of big banks loan portfolios are concentrated in commercial real estate compared to small banks, where average exposure falls around 21.6% of loans.

Sherman Analytics and UBS and Meme generator contributed to this post.