I have been watching Private Equity firms for several years now. They are taking more and more firms off the market. Name the industry and they are there… even down to carwashes and trailer parks!

Removing these firms from the equity markets reduces the available stocks for the average investor to invest in. Prices are being run up and then the CPA’s take over and the quality of the product starts to degrade.

Leverage… borrowed money…increased risk… and they are interconnected. Remember 2008 and when one bank failed, it started a avalanche and the Federal Reserve stepped in and back stopped the “chosen banks”.

PE firms use “leverage” to magnify their profit potential but leverage works both ways… UP AND DOWN!

More and more mid-level, mostly regional, banks are showing up on the banking “watch lists” and that is never, ever, a good sign.

Some of you may remember Hills Street Blues and the famous line the Sargent always said at the beginning of a shift: “Hey, let’s be careful out there.”

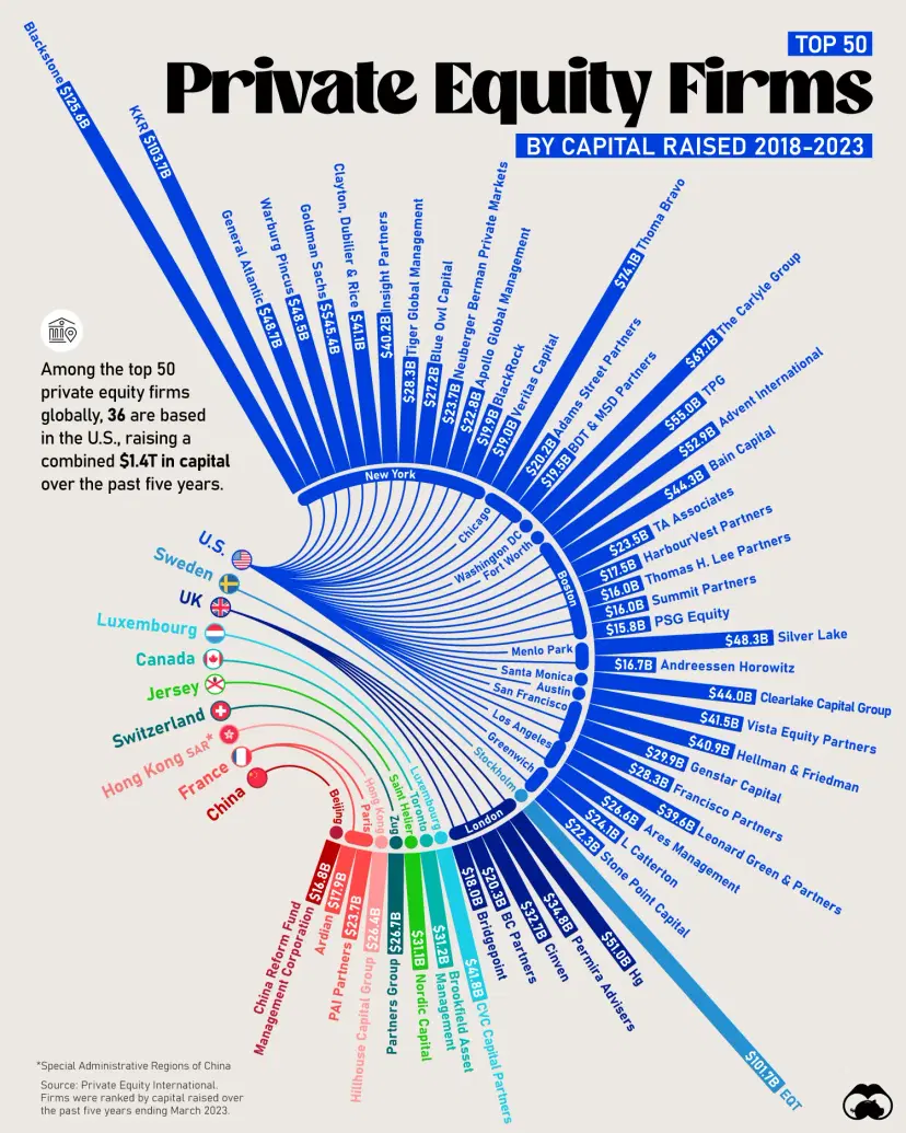

Thank you Visual Capitalist for the graph this week!