I had an email and follow up phone conversation with an old financial guy last week on this very topic.

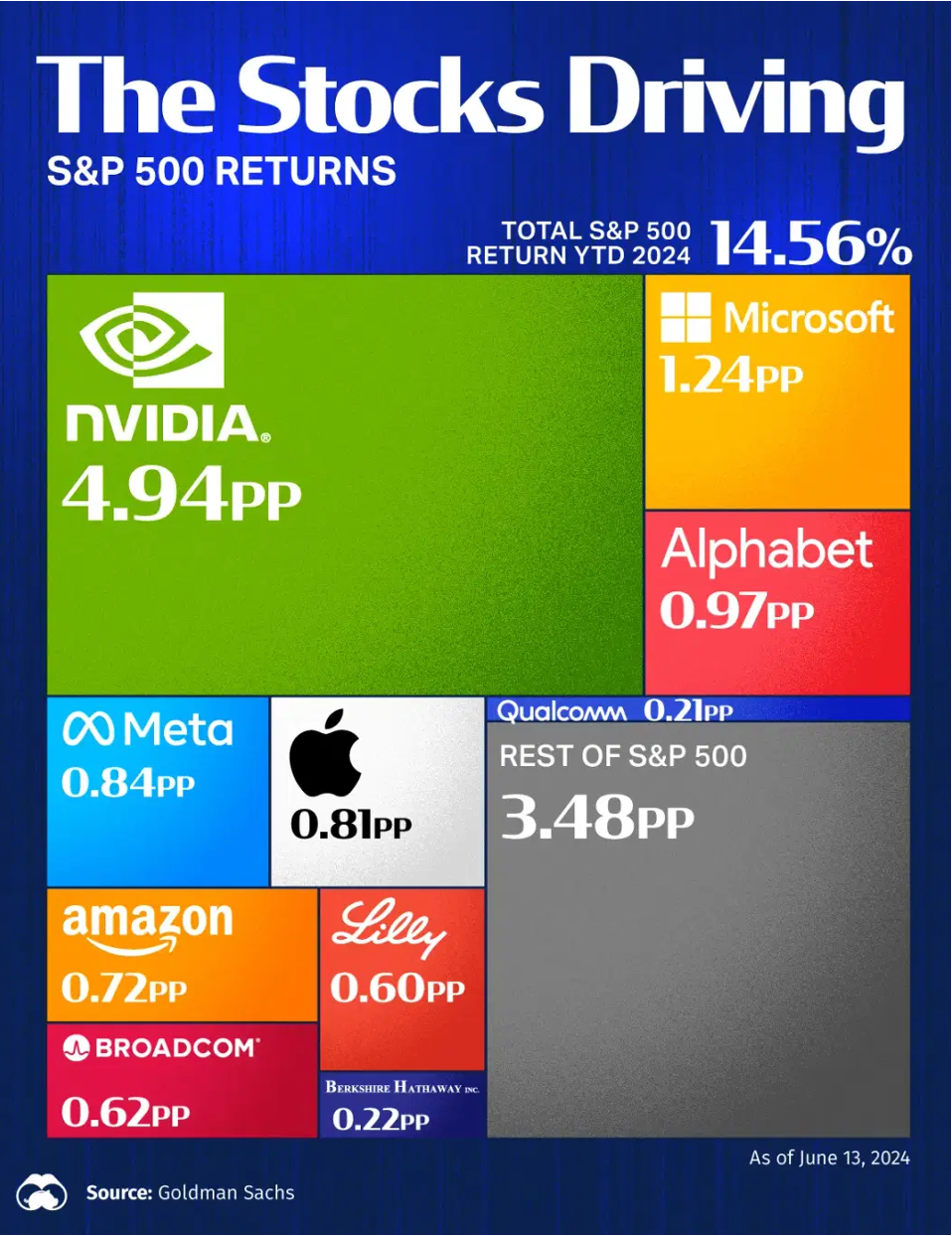

There is much talk about the “Magnificent 7” and this graphic does a top 10 look. It is really one company driving the index. I have a feeling at this point there is a lot of money that falls under FOMO.

This graphic shows the top 10 stocks fueling the S&P 500 by rates of return for the index by each of these companies.

What a difference a week can make.

Tesla was a drag on the index by 0.46 year to date thru Q2. The past week it was up 27.73% while the index return over this same period was 2.07.

No clue why they didn’t just use “%” vs “PP” but they didn’t ask me…

The next two quarters should be interesting.

I don’t just blindly follow what the computer algorithms say. There are trends, sentiment and several other metrics but, I will tell you the sentiment indicators are flashing warning signs too numerous to go thru.

The complacency level in this current market is deafening. There are very few stocks that are pulling the averages up the hill at this point. The investment pond has way too many black swans circling.