Some things don’t matter until they do… and nothing should surprise you at this point in the markets.

If market events and movements surprise you, you need to widen your view.

What is CAPE?

Why does it matter?

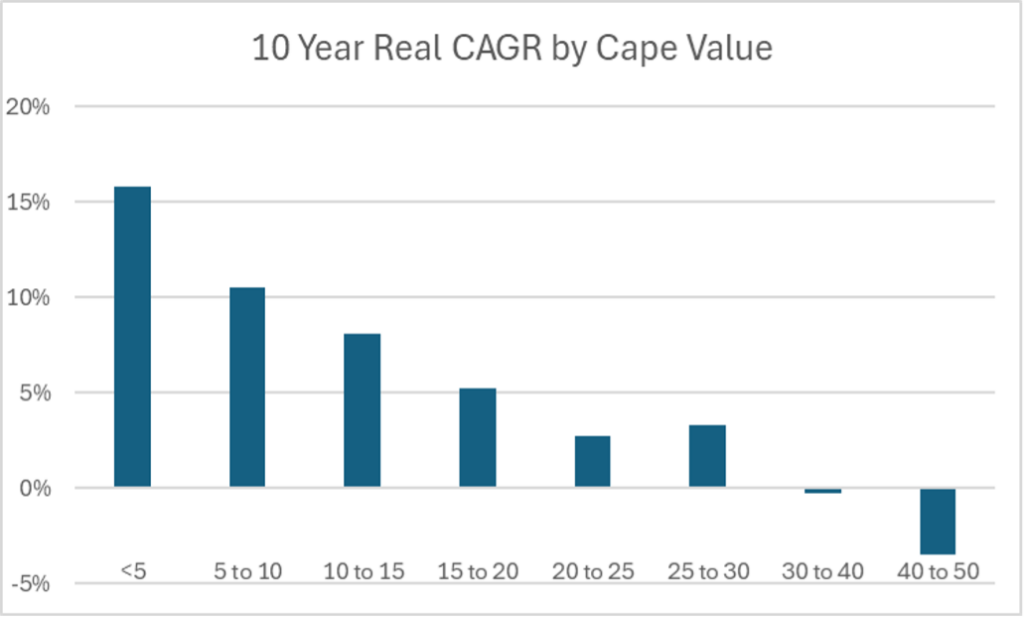

The S&P 500 Shiller CAPE Ratio, also known as the Cyclically Adjusted Price-Earnings ratio, is the ratio of the S&P 500’s current price divided by the 10-year moving average of inflation-adjusted earnings.

The metric was invented by American economist Robert Shiller and has become a popular way to understand long-term stock market valuations. It is used as a valuation metric to forecast future returns, where a higher CAPE ratio could reflect lower returns over the next couple of decades, whereas a lower CAPE ratio could reflect higher returns over the next couple of decades, as the ratio reverts to the mean.

As with all market measurements, you should not rely on just one. This is one of many that should give you pause when you are making investment allocation decisions.

This is not a predictive tool.

THE Current CAPE Ratio: 36.98

The 10-year CAGR of the Market with CAPE values between 30 and 40 is -0.3% going forward based on history going back to 1926.

If you didn’t see this last week, I encourage you to look at it now.

https://legacywealthmgt.net/reagan-vs-trump-and-the-markets/

BONUS!

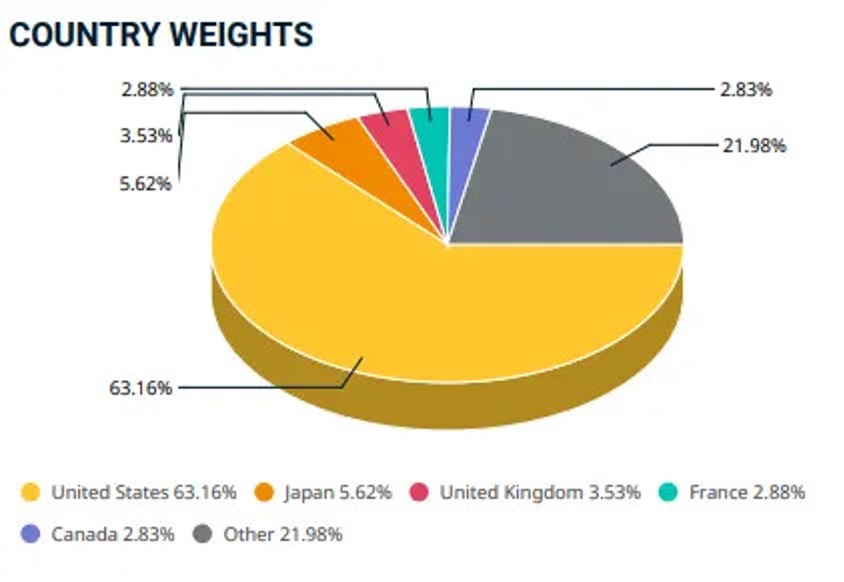

MSCI World Index

The MSCI World Index captures large and mid-cap representation across Developed Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

You would think “world” would offer diversification…

The top 10 stocks in this index are all US and account for 26.3% of the index.

Diversified? …Maybe not.